Biweekly plus extra payment mortgage calculator

Ad Compare Mortgage Options Calculate Payments. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis.

Biweekly Mortgage Calculator How Much Will You Save

Paying off mortgage early calculator.

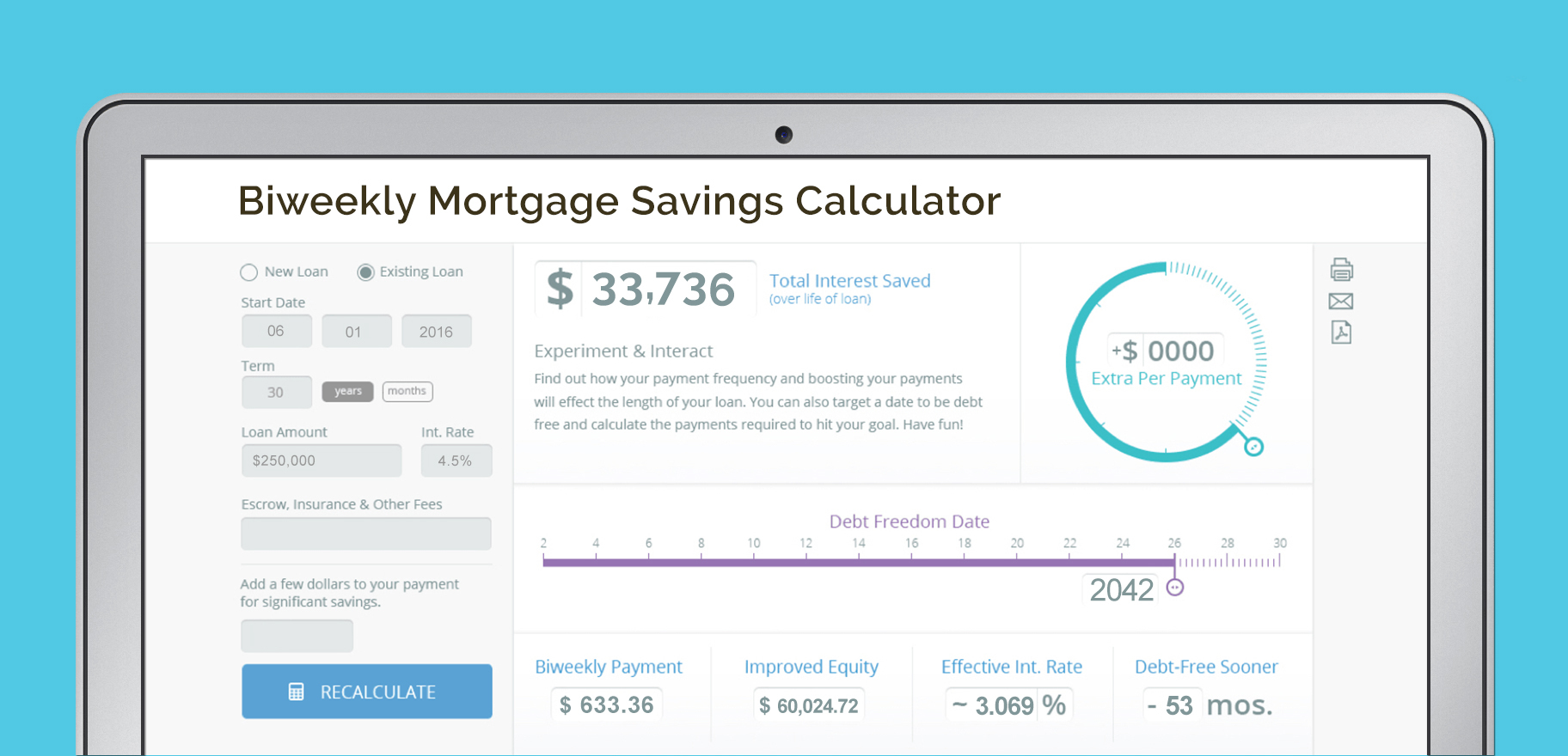

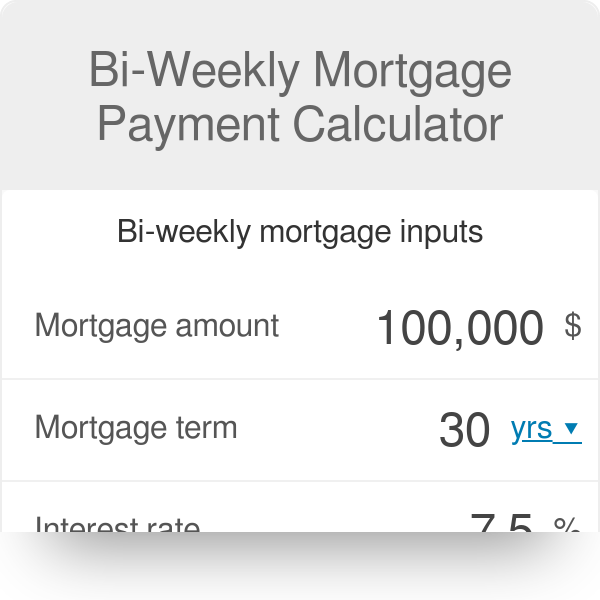

. Biweekly Mortgage Calculator This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run. Many people are paid on a biweekly basis. The calculator will figure your bi-weekly mortgage payments for fixed-rate mortgages of up to 40 years.

Get The Service You Deserve With The Mortgage Lender You Trust. The results from the calculator are only estimates. By paying extra 50000 per month the loan will be paid off.

Months ahead of scheduleInterest savings. Biweekly repayment Normal repayment Payoff in 14 years and 4 months The remaining term of the loan is 24 years and 4 months. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

What This Calculator Does. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly. How we make money.

Apply Now With Quicken Loans. Together with your other homeownership expenses your. Bankrate is compensated in exchange for featured placement of.

You could pay off this debt. The bi-weekly payments are set. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

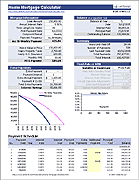

This calculator provides amortization schedules for biweekly payment mortgages with or without additional payments where the payments are applied. See the results for Free refinance calculator mortgage in Los Angeles. Borrowers who want to.

This calculator shows you possible savings by using an accelerated biweekly mortgage payment. According to the example your regular principal and interest PI payment is 116752 while the bi-weekly payment is 58376. Current Plus Extra Bi-Weekly Bi.

690 rows Biweekly mortgage calculator with extra payments excel to calculate. Biweekly savings are achieved by simply paying your monthly mortgage payment every two weeks and making 1 12 times your monthly mortgage payment every sixth. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Find A Great Lender Today. This calculator helps homeowners pay off their loans faster by having them pay half of their regular. Its Never Been A More Affordable Time To Open A Mortgage.

The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments. Bi-weekly Mortgage Payment Calculator. Get Your Estimate Today.

Mortgage Payment Calculator With Amortization Schedule

Autopayplus Redefines The Crowded Online Mortgage Calculator Space Business Wire

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Bi Weekly Mortgage Payment Calculator

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template