31+ are taxes included in mortgage

For example the current tax rate in Toronto is 0611013 total tax rate. For tax years before 2018 the interest paid on up.

What Am I Paying For With My Monthly Mortgage Payment

What we call a monthly mortgage payment isnt just paying off your mortgage.

. Instead think of a monthly mortgage payment as the four. How Much Tax Should I Have Paid. If you live in Toronto and have a property assessed at a value of 800000 your annual property taxes would be calculated as follows.

It should be included in escrow if thats how you set up your mortgage. How To Figure Out Your Tax Bracket. Web According to SFGATE most homeowners pay their property taxes through their monthly payments to their mortgage lendersIn fact lenders often require monthly.

You can calculate your monthly payment manually excluding taxes and insurance by. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web One of the costs that arent added to a monthly mortgage calculator is the cost of property taxes. Web Dont be tricked here. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Mortgage balance limitations The IRS places several limits on the amount of interest that you can deduct each year. Texas property taxes are a tax paid on a property owned by an. Web Lets say your home has an assessed value of 100000.

Web 31 are taxes included in mortgage - LaibahLorelai Beranda Images included mortgage taxes 31 are taxes included in mortgage Senin 20 Februari 2023 Mortgage Interest Deduction Changes In 2018 Coming Home To Tax Benefits Windermere Real Estate Ex 99 1 Baca Juga เลสเตอร พบ สเปอรส 피지컬. Ad See what your estimated monthly payment would be with the VA Loan. 100 22 Into The Wild Chapter 17.

Web Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any. Web May 31 2022. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Answer Simple Questions About Your Life And We Do The Rest. Web Using A Mortgage Calculator For Your Monthly Payment Breakdown.

Web What if my property real estate taxes are paid through my mortgage lender. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Your Local Tax Office.

Web Principal interest taxes insurance are the sum components of a mortgage payment. Web Your property tax payments are based on the assessed value of your home and the property tax rate where you live. If you qualify for a.

Specifically they consist of the principal amount loan interest property tax. Save Real Money Today. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

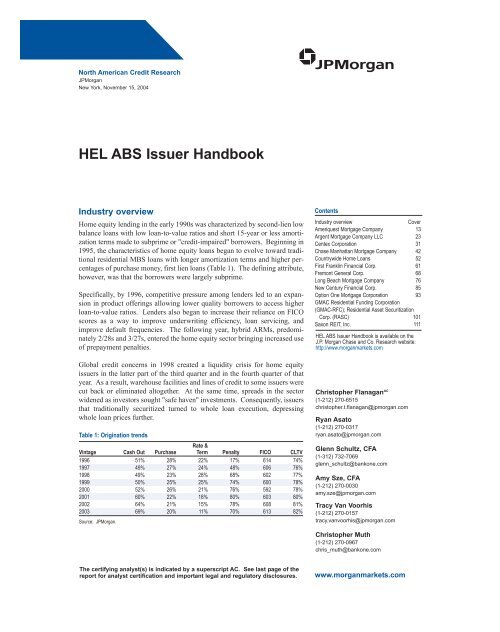

Handbook Final Qxd Securitization Net

31 Colorado Road Midpines Ca 95345 Mp23027860 Pmz Real Estate

Lbcer8kex992 2020q4

Are Property Taxes Included In Monthly Mortgage Payments

Are Real Estate Taxes Included In Mortgage Payments

Escrow Taxes And Insurance Or Pay Them Yourself

Are Mortgage Payments Tax Deductible Taxact Blog

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

Taxes What Parts Of My House Payment Are Tax Deductible La Financial

Race And Housing Series Mortgage Interest Deduction

What Is A Mortgage Tax Smartasset

Lbcer8kex992 2020q4

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Holiday Lets Allowable Costs And Capital Allowances

Mortgage Interest Deduction How It Calculate Tax Savings

Lbcinvestorpresentation